Proposed rates of tax 2011

A-46, CHAPTER - XVI, RATES OF INCOME TAX

16.1 Tax rates are determined by the size of the tax base; if the tax base is higher, the tax rates can be lower. For the purposes of this Discussion Paper, the tax rates provided are such rates which are expected to yield the existing level of revenues with the revised comprehensive tax base proposed in this Code.

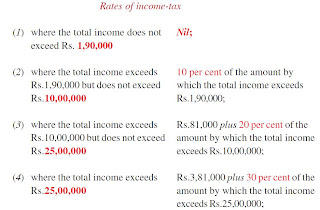

16.2 The rates of taxes are provided in the First Schedule to provide stability to the income tax regime.

16.3 The new tax rate for individual taxpayers can be substantially liberalised to levels (click on tables) below:

In the case of every individual, other than women and senior citizens In the case of woman below the age of sixty-five years at any time during the financial year

In the case of woman below the age of sixty-five years at any time during the financial year In the case of senior citizens

In the case of senior citizens Direct Taxes codeDiscussion Paper

Direct Taxes codeDiscussion Paper

Disclaimer

The contents posted on these Blogs are personal reflections of the Bloggers and do not reflect the views of the "Report My Signal- Blog" Team.

Neither the "Report my Signal -Blogs" nor the individual authors of any material on these Blogs accept responsibility for any loss or damage caused (including through negligence), which anyone may directly or indirectly suffer arising out of use of or reliance on information contained in or accessed through these Blogs.

This is not an official Blog site. This forum is run by team of ex- Corps of Signals, Indian Army, Veterans for social networking of Indian Defence Veterans. It is not affiliated to or officially recognized by the MoD or the AHQ, Director General of Signals or Government/ State.

The Report My Signal Forum will endeavor to edit/ delete any material which is considered offensive, undesirable and or impinging on national security. The Blog Team is very conscious of potentially questionable content. However, where a content is posted and between posting and removal from the blog in such cases, the act does not reflect either the condoning or endorsing of said material by the Team.

Blog Moderator: Lt Col James Kanagaraj (Retd)

No comments:

Post a Comment